Bank Of Baroda Fixed Deposit Rates

A fixed deposit (FD) is the financial facility provided by almost all the banks. In this scheme, individuals have to deposit a fixed amount in a bank for a fixed period of time. And after the said period, individuals will get a deposited amount with the decided interest. The interest rate of the fixed deposit (FD) is higher than the regular savings account. Today on this page, we will discuss the BOB FD interest rate, features, benefit, and other important points.

Bank of Baroda FD rates for senior citizens is 0.50% more than those for the general public. Benefits of Fixed Deposit schemes offered by Bank of Baroda are: Provides the option to avail loan against fixed deposits for up to 85% to 95% of the fixed deposit amount. Offers the option to withdraw money prematurely at a nominal penalty of 1%. Get all the details on Bank of Baroda Fixed Deposit/Term Deposit, NRI/NRE/NRO Deposit Rates, Interest Rates, Fixed Deposits Rating, Fixed Deposits Schemes, NRI deposit rates Bank of Baroda.

For interest rates for deposits of Rs. 2 Crores and above, Please contact our nearest branch. Interest is calculated on daily product basis and is credited on quarterly basis in the months of April, July, October and January every year. Saving Bank deposits rates w.e.f. The latest FD rates on SBI deposits is effective from 10th January 2020. The bank has cut the FD rates by 15 bps on long-term deposits maturing in 1 year to 10 years. Now FD interest rate for 7 to 45 days is 4.50%, for 46 to 179 days is 5.50%, for 180 days to 1 year is 5.80%. Above 24 months to 36 months.The BOB NRE Fixed Deposit interest rates are subject to change at the discretion of the bank. The interest rates mentioned in this table are valid as of 10 January 2020.

Bank of Baroda offers various fixed deposit (FD) options with an excellent rate of interest (ROI). The BOB provides the FD scheme for both long as well as a short period of time. The Bank Of Baroda FD Interest rate are set as per the category of the individuals. Like the senior citizen will get the 0.50% extra interest p.a. over regular rates.

Bank of Baroda FD- Special Features

- The Bank of Baroda provides Fixed Deposit Facility from 7 days to 10 years

- Senior citizens who have holding Fixed Deposit in BOB can enjoy the interest hike of 0.50% p.a. over regular rates.

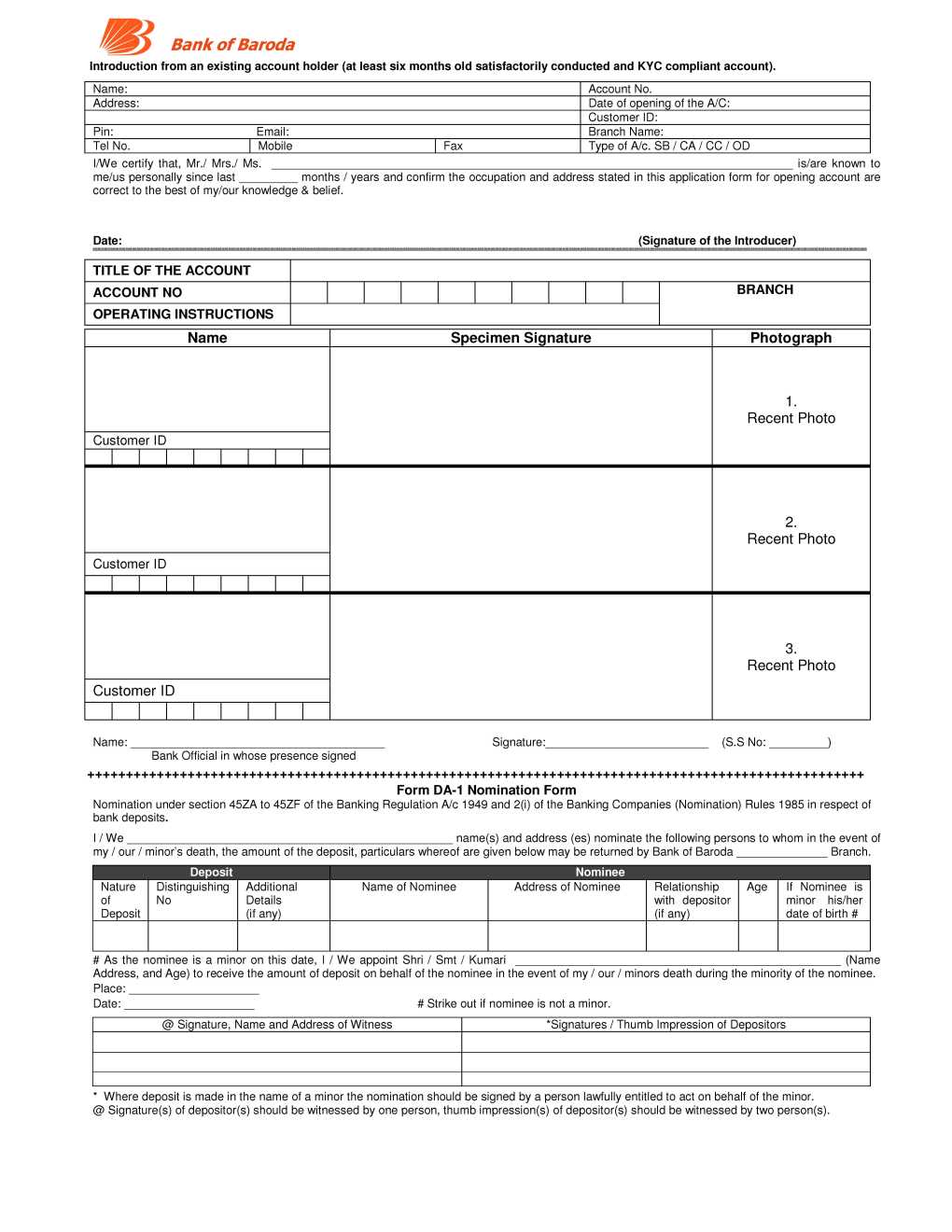

- Nomination facility is provided by the bank

- Any account holder can open his/her account in BOB with a minimum of Rs 1,000

- An individual can also take the loan up to 90% of the available deposit

- Interest on the fixed deposit will be paid only at the time of maturity

- Various schemes provided by the BOB for fixed deposit

- Short Deposit

- BOB Suvidha Fixed Deposit Scheme

- Baroda tax Savings Term Deposit

- Regular Income plan

- Baroda Double Dhamaka Deposit Scheme

- Money Multiplier Deposit

- Baroda Advantage Fixed Deposits Non-Callable

- Fast Access Deposit

- Monthly Income Plan

BOB Fixed Deposit- Benefits

- A person having a fixed deposit with the bank has an option to take a loan up to 85% – 95% against FD.

- An individual can also withdraw their fixed deposit by paying a penalty of 1%

- The bank will charge no penalty for deposits in-force for a minimum of 12 months

- You can also set an auto-renewal for FD

- The FD holder can also choose a nominee as per his/her choice.

- The bank will not charge any fees for any for loans and advances against fixed deposits

Bank Of Baroda FD Interest Rate

Bank of Baroda FD Rates- NRE

Bank of Baroda Fixed Deposit Rates- FCNR (B)

Bank of Baroda- Tax Savings Term Deposit

- बैंक सखी योजना क्या है Bank Sakhi Scheme – योग्यता, ऑनलाइन फॉर्म की जानकारी - June 22, 2020

- Bad bank (बैड बैंक) क्या है What is Bad Bank Explained in Hindi - June 22, 2020

- टर्म इन्शुरन्स क्या होता है Term Life Insurance Explained in Hindi - June 22, 2020

FD Calculator Bank of Baroda in India 2019

| Tenure | Rates | Maturity Amount for Rs. 1 Lakh |

| 2 years 1 day to 3 years | 6.70% to 7.20% | Rs. 114,233 – Rs.123,872 |

| 15 days to 45 days | 4.50% to 5.00% | Rs. 100,185 – Rs.100,616 |

| 3 years 1 day to 5 years | 6.70% to 7.20% | Rs. 122,081 – Rs.142,875 |

| 7 days to 14 days | 5.25% to 5.50% | Rs. 100,101 – Rs.100,211 |

| 46 days to 90 days | 4.75% to 5.25% | Rs. 100,599 – Rs.101,295 |

| 91 days to 180 days | 5.50% to 6.00% | Rs. 101,371 – Rs.102,980 |

| 181 days to 270 days | 6.25% to 6.75% | Rs. 103,123 – Rs.105,076 |

| 271 days to 364 days | 6.25% to 6.75% | Rs. 104,712 – Rs.106,903 |

| 1 year | 6.45% to 6.95% | Rs. 106,608 – Rs.107,133 |

| 1 year 1 day to 400 days | 6.60% to 7.10% | Rs. 106,784 – Rs.108,018 |

| 400 days to 2 years | 6.55% to 7.05% | Rs. 107,380 – Rs.115,001 |

| 5 years 1 day to 10 years | 6.45% to 6.95% | Rs. 137,727 – Rs.199,179 |

Bank of Baroda Fixed Deposit Calculator

Bank of Baroda FD Calculator offers the best interest rates upto 6.70% on its fixed deposits. Use FD Calculator of Bank of Baroda to calculate your maturity amount on the basis of current FD interest rates. Input your investment amount, interest rate & tenure to know your matured amount.This will give the details of investment that’s the principal amount on maturity after the interest is compounded on days or a monthly, quarterly, half-yearly and yearly basis.

- Deposit amount

- Rate of interest

- FD tenure

- Compounding frequency

- TDS applicability and TDS rate

Documents required to open Bank of Baroda FD account

1. Identity proof

- Passport

- PAN card

- Voter ID card

- Driving license

- Government ID card

- Photo ration card

- Senior citizen ID card

2. Address proof

- Passport

- Telephone bill

- Electricity bill

- Bank Statement with Cheque

- Certificate/ ID card issued by Post office

Types of Fixed Deposit offered by Bank of Baroda

Bank Of Baroda Fixed Deposit Rates Singapore

- Fixed/Short Term Deposit– A standard FD scheme offered by Bank of Baroda wherein customers are paid fixed interest amounts at regular intervals.

- Quarterly/Monthly Term Deposit– In this scheme, customers can choose to receive interest payments at monthly or quarterly intervals

- You can also choose to receive payment at the end of the maturity period.