Bank Of Baroda Saving Account Interest Rate

- Bank Of Baroda Nre Saving Account Interest Rate

- Bank Of Baroda Saving Account Interest Rate Latest

- Bank Of Baroda Saving Account Interest Rate Calculator

- Bank Of Baroda Saving Account Interest Rates

Savings accounts are a simple, convenient and hassle-free option to save and manage your money.

- The bank has cut the FD rates by 15 bps on long-term deposits maturing in 1 year to 10 years. Now FD interest rate for 7 to 45 days is 4.50%, for 46 to 179 days is 5.50%, for 180 days to 1 year is 5.80% and for 1 year to 10 years is 6.10%.: Axis Bank reduced FD interest rate. Axis Bank reduced interest rates by up to 20 bps from.

- Bank of Baroda UK is owned by Bank of Baroda in India, which in turn is owned by the Indian government. The bank has had a presence in the UK since 1957. Today it has 10 branches in the UK and offers banking services to individual, business and corporate customers.

- Apply & Open Bank of Baroda salary advantage savings account online & get 4% interest rate with zero minimum balance required.

- Interest Rates on Deposit (AED) w.e.f.Terms: Rates are subject to change from time to time and Negotiable. Rate of interest on various deposits (including NRI Deposits) and advances in India please click here. For Deposit other currency and less than AED 25000 please contact to branch.

Bank of Baroda interest rates 2021 बचत जमाराशियां ब्याज दर (% प्रति वर्ष) (01.09.20 से प्रभावी) रु. 1/- लाख तक के बचत जमा शेष. 1/- लाख से अधिक के बचत जमा शेष. 2.75 Interest rate in Fixed deposit in Bank of Baroda. Bank of baroda fd.

With an extensive range of features and benefits, savings accounts from Bank of Baroda are ideal for all types of investors.

BOB Savings Account – A convenient, secure and easy banking

Benefits

Bank Of Baroda Nre Saving Account Interest Rate

- Savings accounts are a flexible and easy-to-operate option for young and seasoned investors alike. As the simplest form of deposit available to customers, savings accounts are among the most popular type of bank deposits.

- Among the many advantages of a savings account are the wide variety of features available to account holders. These benefits of range from multiple withdrawal options to simple terms and conditions.

Features

- As a customer, you can enjoy the many features of a savings account free of cost or for minimum charges.

- You may also apply for our internet banking on your savings account free of cost. With internet banking, you can access your bank statements and remain up to date with your transactions.

- If subscribed, you will receive monthly password protected e-statement free of cost on e-mail.

- Bank of Baroda pays interest on all savings accounts, the interest of which, is transferred to your savings account every quarter, though it is calculated daily.

- You may need to maintain a certain minimum balance in your savings account, depending on the type of account you hold. The minimum opening balance and the minimum balance requirement for a savings account with cheque book is SCR 500.00 and without cheque book, it is SCR 200.00. There are also charges for non-maintenance of sufficient balance in your savings account.

Most Important Terms & Conditions

Bank Of Baroda Saving Account Interest Rate Latest

Transactions of saving oriented nature are permitted. Commercial transactions are non allowable transactions. If non allowable transactions are noticed then Bank may close the account with prior notice/intimation citing reasons thereof.

Interest calculation and frequency

Interest is paid to the account on half yearly basis at the prevailing rate of interest.

Withdrawal(s)& use of Withdrawal Form (Slip)

Withdrawals will be allowed either by withdrawal forms and by cheques in accounts having cheque book facility.

Bank Of Baroda Saving Account Interest Rate Calculator

Bank Card

All saving bank account holders are issued with a bank card containing account details with photograph free of cost for first time. In case of loss of bank card, customers are requested to inform immediately. Duplicate Bank card can be issued to such customers on payment of applicable charges.

Statement of account

- Password protected monthly E-statement is sent to all customers with valid e-mail id in Bank’s records

- Account Statement is also sent free of cost by post on half yearly basis i.e. June & December

- Duplicate statement is also issued over the counter on chargeable basis.

Cheque book

Printed CTS cheque books are issued to eligible accounts on chargeable basis.

Registration and execution of Standing instructions

- No charge within the Bank

- Rs. 20/- per transaction plus applicable remittance charges in case of credits for other bank accounts.

- Rs. 500/- per occasion will be levied for Standing instruction failure because of insufficient fund.

Closure of account and charges

- All the authorized signatories of the account will give in writing his/her/their intention to close the account. The relative bank card and the unused cheque leaves should be surrendered along with the letter requesting closure.

Dormant/Inoperative Account

- Account becomes inoperative/dormant if there are no customer induced debit transactions in Savings account for over a period of two years. Interest is continued to be applied in all such Savings Bank accounts. No charges are levied for inoperation of accounts.

- Activation/Closure of Dormant/Inoperative accounts will be done after submission of necessary KYC documents, photo, fresh specimen signature,subject to satisfaction of the Bank.

- All Accounts which have remained inoperative/dormant for a period of 10 years and above will be treated as Abandoned properties and will be transferred to Central Bank of Seychelles. Upon receipt of the request from the customer with necessary identity and address proof for proper identification of the customers, such deposits will be refunded to account subject to compliance of other conditions.

Disclosure of information

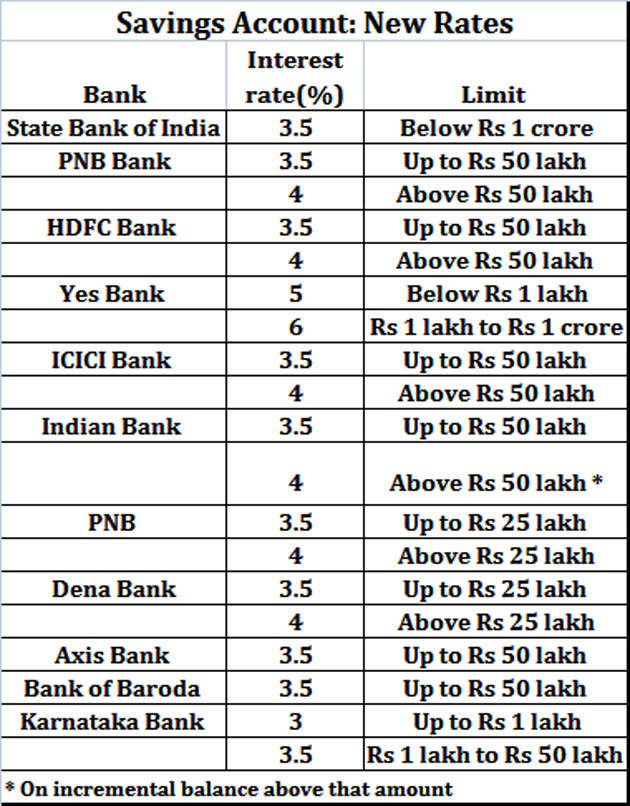

Bank Of Baroda Saving Account Interest Rates

The Bank may disclose information about customer’s account, if required and permitted by law, rule or regulations, or at the request of any public or regulatory authority or if such disclosure is required for the purpose of preventing frauds, or in public interest, without specific consent of the account holder(s).

The Bank will notify, 30 days in advance, any change in terms and conditions/ Fees and charges on its website.

Minimum Account opening balance/Minimum balance requirement.

Saving Bank account with Cheque Book : SCR 500

Saving Bank account without Cheque Book : SCR 200

Charges for not maintenance of minimum balance : SCR 50

For scheme specific MITC, please contact the branch.

- *All charges are subject to changes from time to time.

Bank of Baroda offers a wide range of features on savings accounts. Apply now to open a savings account and enjoy its numerous benefits.

Available Services for Saving Account Holder

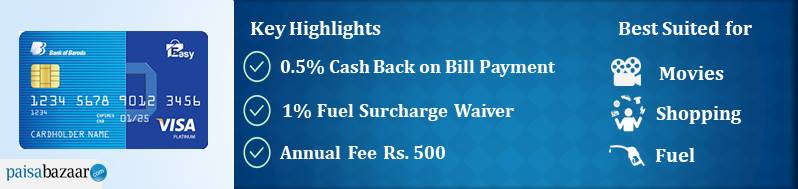

- Free International Debit card

- Free Internet Banking

- Standing Instructions facility

- Free SMS Alert Facility

- Free Monthly E-statement

- Locker Facility

- Foreign Exchange Facility

- Remittance Facility

- Personal Finance

Where your money is fully safe, earns interest and is convenient to withdraw.

CRITERIA FOR OPENING A SAVINGS BANK ACCOUNT

- National Identity Card (NIC) for a Mauritian Citizen

- Passport (for a foreigner residing in Mauritius ) along with work permit/ resident permit

- Proof of Residential Address

- Original of recent Utility Bills /Local Authority tax bill etc.

BENEFITS

- Easy to operate.

- Provides liquidity to meet with all types of payment obligations and gateway for other banking services.

- Tool to cultivate Banking habits in your kith and kin.

- Free issuance of ATM/Debit cards, accepted worldwide.

- Direct debit facilities to meet various bill payments.

TERMS AND CONDITIONS

- No minimum and maximum period.

INTEREST PAYMENT TO INDIVIDUAL CUSTOMERS ONLY

- 0.50% per annum W E F 05.05.2020 payable on 1st June and 1st December

- Balance of Rs 5000.00 and above would only be eligible for payment of interest