Hdfc Fixed Deposit

In order to open a fixed deposit in HDFC Bank Online or Offline first of all you need to open a bank account in HDFC Bank. Once you have a bank account in HDFC Bank, there are 2 ways of getting a fixed deposit in HDFC Bank. First way is to login to your HDFC Internet Banking Account and open a fixed/term deposit in HDFC Online. Another way is to open a Fixed Deposit by personally visiting your HDFC Bank Home Branch. Before we proceed to know how to open fixed deposit in HDFC Bank or FD in HDFC Bank, let’s know what is a fixed deposit and some important things you must know to open a term deposit in HDFC Bank or FD in HDFC Bank.

What is a Fixed Deposit in HDFC Bank ?

A fixed deposit in HDFC Bank is nothing but a lump sum investment in the bank which provides investors with a higher rate of interest than a regular savings account till the given date of maturity.

How to Open Fixed Deposit in HDFC Bank Online ?

In order to open a fixed deposit account in HDFC Bank Online, first of all you need to make sure that you have already registered and activated internet banking in HDFC Bank. If you have still not applied for Internet Banking in SBI, you must apply, register and activate internet banking in HDFC Bank. If you have forgot your Internet Banking IPIN, you can regenerate HDFC IPIN within minutes.

Once you have your HDFC Internet banking User Name and Password, and at least one transaction account mapped to the username, you can proceed with the process to open a Fixed Deposit in HDFC Bank.

Let’s now know the step by step procedure to open a fixed deposit in HDFC Bank Online.

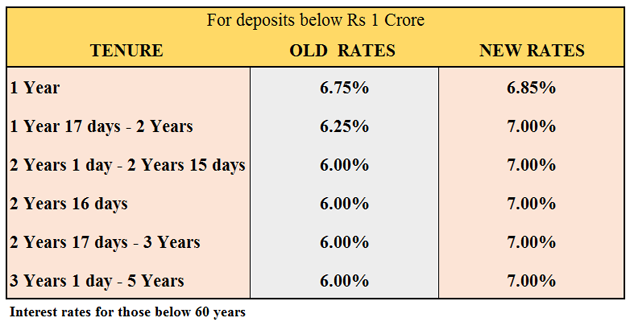

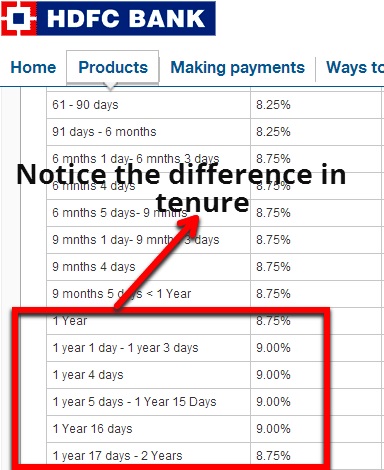

Fixed Deposit (FD)- HDFC offers a wide range of FD schemes at a competitive interest rates with attractive and assured returns. Visit us at HDFC to know more benefits. HDFC Bank, India's leading private sector bank, offers Online NetBanking Services & Personal Banking Services like Accounts & Deposits, Cards, Loans, Investment & Insurance products to. Interest Rates - Fixed & Recurring Deposits, Savings Account, Forex HDFC bank offers attractive interest rates on various deposit and savings schemes. Click on the header to view the rates Fixed Deposit Interest rate Less Than 5 Cr. Interest on My Passion Fund will be calculated by the bank in accordance with the directions advised by Indian Banks' Association. Interest rates for My Passion Fund will be the corresponding rate as applicable for a Fixed Deposit. Interest on the My Passion Fund is. One of the best parts of HDFC deposits is that you get tailor made deposits which suit your specific needs. For senior citizens who are more than 60+ years of age, an additional 0.25% will be offered to them on all of the deposits products. DEPOSIT PLANS AND FIXED DATES Monthly Income Plan - Last day of every month.

Step 1 : First of all you need to open HDFC Bank Netbanking Website.

Step 2 : Sign in to your HDFC Bank Netbanking Account by entering your Customer ID and Password.

Step 3 : Find the ‘Fixed Deposit’ Option on the left sidebar.

Step 4 : Click on ‘Open New Fixed Deposit < Rs.1 Cr’ to open a Fixed Deposit Account in HDFC Online.

Step 5 : Now fill all the necessary information to create your Fixed Deposit Account in HDFC Bank.

- Account Number

- Home Branch/Others

- State (If Other than Home Branch is Selected)

- City (If Other than Home Branch is Selected)

- Branch (If Other than Home Branch is Selected)

- Deposit Amount(You can also View FD interest rates)

- Nature of Deposit

- Deposit Period

- Maturity Instructions

- Interest Payable

- Interest Payable Mode

- Principal and Interest Credit Account No.

Step 6 : Click on Continue to Proceed.

Step 7 : Put a check mark on the 2 check boxes at the bottom of the page and click on Confirm.

You’re done !

How to Open Fixed Deposit in HDFC Bank Offline ?

If you don’t have an internet banking account in HDFC Bank, you don’t have to worry. You can also open a fixed deposit in HDFC by visiting your HDFC Bank Home Branch. You just need to follow the simple steps given below and you will soon have a HDFC Bank fixed deposit account.

(1) Filling the Fixed Deposit Form

You can either collect a form for HDFC Bank Fixed deposit from your Home Branch or you can download the HDFC FD Form Online. Once you have the Fixed Deposit Form of HDFC Bank, you need to fill in all the required details.

(2) Gathering the Required Documents

Once you fill up the fixed deposit form, you need to gather all the documents which are required to open a Fixed Deposit Account in State Bank of India. You may be asked to submit self attested photostat copies of your PAN Card and Address Proof.

(3) Verifying the Documents for Term Deposit Account

Once you have filled the fixed deposit form and you have the required documents with you, you need to Visit the HDFC Bank Home branch to verify your documents.

(4) Submitting the Amount for Fixed Deposit in HDFC Bank

Fixed Deposit Rates In India

Once your documents are verified, you need to make sure that you have at least the amount in your bank of which you need to open Fixed Deposit. If not, then you must deposit the amount.

Hdfc Fixed Deposit Online

(5) Opening the HDFC Fixed Deposit

Finally, you will need to submit all your documents along with the cash voucher(if you have submitted an amount). You will either be given your Fixed Deposit Account Details on the same day or you will be given a date on which you can collect your details.

These are the 2 different ways by which you can open a fixed deposit account in HDFC Bank. In my opinion, opening a fixed deposit online is an easy task and would not take more than 5 minutes. The only condition is that you need to have a net banking account in HDFC Bank.

You may also like to Read :

OVERVIEW OF DEPOSITS

HDFC began their deposits scheme more than 3 decades ago. Customers have chosen HDFC for fixed deposits plainly because of their consistent performance. Because of this trust, there are more than 6 lakh depositors today and it is increasing by the day.

India's leading rating agencies (CRISIL & ICRA) have rated HDFC's deposits program as 'AAA' which is considered as a good benchmark! You would be astonished to know that for 24 years HDFC has consistently achieved this rating which shows its consistency and trust of customers and partners.

HDFC believes that a good brand always takes care of its customers and the customers in turn will ensure that the brand grows with time. Hence enhance customer satisfaction has been the core of each product offering.

HDFC depositors can get services via 420 inter connected offices which are spread all over India. Around 77 deposit centers provide customers with instant services.

HDFC has been known to set very high benchmarks of service delivery consistently over the years. They do this by providing instant services like electronic payment facility for interest payment, instant loan against deposit & many value added services.