Kotak Saving Account Interest Rate

A Savings Account is very beneficial with multiple advantages as detailed below:

(1) Earns Interest on your Savings

June 14, 2019, earn 6% p.a. Interest on savings account balance over Rs. 1 lakh and up to Rs 1 cr. Interest on savings account balance up to Rs. 1 lakh and 5.5% p.a. Interest on savings account balance above Rs. Applicable for Resident Accounts only.

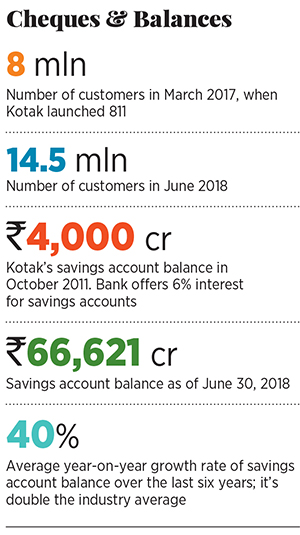

Dec 11, 2020, interest rate of 4% p.a. Will be applicable on daily balances in Savings Account over Rs. 1 lakh and up to Rs. 1 crore while interest rate on daily balances in Savings Account above Rs. 1 crore stands revised at 3.50% p.a. These interest rates are applicable for Resident Accounts only. Saving Account Interest Rate Calculator. A Savings Account Interest Rate Calculator will let you find out the interest that you will get from a savings account. In a Savings Account Interest Rate Calculator, you will be required to enter information like average balance and interest rate offered by the bank. You will also be required to select. 811 Savings Account for Everyone. Kotak 811 is a zero balance digital bank account available to everyone (Resident Indian individuals only). Kotak 811 lets you choose between a zero balance account or an 811 Edge savings account based on your needs, which acts as a one stop solution for all your financial needs and day to-day transactions. KOTAK Mahindra Bank Home Loan Interest Rate 2021. Kotak Mahindra Bank offers home loans at attractive interest rates and zero processing fee for online applicants. There are home loans for residents and NRIs, as well as home improvement loans. The interest rates range from 6.75% p.a.

This is the first and foremost benefit of opening a savings account. It starts earning interest on your money as soon as it is deposited. The interest rate is decided solely by the bank and changes from time to time. Regular interest depends upon the balance of the savings account.

Interest rate in savings account ranges from 3.5% to 7%.

(2) Provides Security of Funds

There is no risk involved in your savings account. It is considered as one of the safest investment alternatives. It even offers you the opportunity to put your money into another investment whenever the time comes.

(3) No Lock-in Period

There is no lock-in period under savings account which means that you can withdraw your deposits anytime you need. There is no need to keep your money in this account for any specific period. You have full flexibility in withdrawal of amount from it.

(4) Offers Liquidity

You can withdraw the amount anytime 24X7 with the use of ATM card or debit card from your account during any emergency even when the bank is closed. In fact, being able to access your money when you need it, is one of the biggest benefit of having a savings account.

(5) Availability of Variety of Savings Account

Many banks offer comprehensive range of savings accounts from regular to premium suiting to your personal banking needs. There are different types of savings accounts offered by various banks that differ based on the interest rates and duration of time commitments. You can choose any of them which suits your financial objectives and requirements.

(6) Services of Customer Relation Manager

Now-a-days many of the banks engage a Customer Relation Manager (CRM) who will help not only solve your queries but also assist you in tax saving, investment, mutual fund schemes, insurance, bank procedures, etc. You need to just call your CRM and he/ she will assist you solve your problem.

(7) Online Banking Facilities

If you maintain a savings account, you can make many transactions online also such as payment of bills, fund transfers using RTGS/ NEFT or IMPS, etc. This will save your time and efforts.

(8) Provides ATM/ Debit Card

You will be offered a debit or ATM card with a nominal charge or without any charges, as offered by your bank. With the help of this card, you can withdraw the funds, make transactions in shops, make payments of bills, etc.

(9) Helps you Get Credit or Loan

The relation you maintain with the bank will help you in getting credits from the bank such as home loan, personal loan. You will also be in a position to negotiate with the banker on the interest rates.

(10) No Cap on Deposits

There is no limit on the amount deposited and number of times it is deposited.

(11) Facility to link Loan EMIs, Mutual Fund SIPs or RD deductions

You get a facility to link your monthly loan EMIs, Mutual Fund SIPs or RD deductions through the savings bank account.

(12) Free Mobile App

Most of the banks provide their mobile app for free. Through this app, you can get to know your account balance, check your statement, make transactions, easy transfer of money, etc.

Savings Account is the oldest and most common form of savings. The reason behind people preferring a savings account over any other form of savings is that here the principal amount is always safe no matter how much interest is earned. It can thus be said that the convenience of keeping the money in a savings bank account and earning interest is also the simplest form of investment.

Features & Benefits of Savings Account

Even though there are so many options to save money, the charm of Savings Account is still noticeable. Zero balance savings account has also got so much attention for its advantage of having the privileges of a savings account without maintaining any minimum balance in it. The features and benefits of Savings Account are as follows

- Safe and secure way to save money

- You can earn interest up to 8% per annum

- There is no minimum balance requirement for zero balance accounts

- Any Indian resident with valid ID proof can open this account

- There are no restrictions on how many bank accounts you can have

- You get ATM withdrawal option and Netbanking

- You can open a joint account with your family member

- Debit card issued can be used for payments

What is the minimum balance for a Savings Account?

The minimum balance required to maintain a savings bank account is subject to change from one bank to another just like the rate of interest. There are mainly two types of savings account - regular savings account and zero balance savings account. Banks have a certain minimum balance limit which an account holder has to maintain else he/she has to pay the penalty.

However, with the changes in other banking products, a savings account has also seen a major shift from being minimum balance account to zero balance savings account. Many banks now offer zero balance savings account due to increased demand as compared to the age-old pattern of keeping thousands in the bank account to avoid penalties. The savings account interest rate on these accounts are also high which makes it even more appealing.

List of All Banks Savings Account Interest Rates and Minimum Balance 2021

Kotak Saving Account Interest Rate

| List of Savings Account Banks | Minimum Balance Required(INR) | Savings Account Interest Rates (p.a.) | Features |

|---|---|---|---|

| Allahabad Bank | 1000 | 3.00% |

|

| Andhra Bank | 0/5//100/1000 | 3.00% |

|

| Axis Bank | 0/10000/25000/100000 | 3.50% - 4.85% |

|

| Bank of Baroda | 0/5/1000 | 2.75% - 3.00% |

|

| Bank of India | 500/5000/10000/20000/100000 | 3.00% - 3.25% |

|

| Bandhan Bank | 0/2000/5000/25000/100000 | 4.00% - 7.15% |

|

| Bank of Maharashtra | 1000 | 2.75% |

|

| Canara Bank | 500/1000 | 3.00% |

|

| Central Bank of India | 50 | 2.75% - 3.00% |

|

| Citibank | 200000 | 2.75% |

|

| Corporation Bank | 0/250/500/2500/15000/100000 | 3.00% |

|

| Dena Bank | 0 | 2.75% - 3.00% |

|

| Dhanlaxmi Bank | 0/5/1000/5000/10000/25000 | 3.50% |

|

| Digibank | 0 | 3.50% - 6.00% |

|

| Federal Bank | 0 | 2.25% - 3.65% |

|

| HDFC Bank | 2500/5000/10000/25000 | 3.00% - 3.50% |

|

| ICICI Bank | 0/1000/2000/2500/5000/10000 | 3.00% - 3.50% |

|

| IDBI Bank | 500/2500/5000 | 3.30% - 3.80% |

|

| IDFC Bank | 25000 | 6.00% - 7.00% |

|

| Indian Bank | 250/500/1000 | 3.00% |

|

| Indian Overseas Bank | 500-1000 | 3.25% - 3.50% |

|

| IndusInd Bank | 0/10000/25000/2500000 | 4.00% - 6.00% |

|

| Jammu & Kashmir Bank | 0/500/1000 | 3.00% |

|

| Karnataka Bank | 0/500/1000/2000 | 3.00% - 5.00% |

|

| Kotak Mahindra Bank | 0/2000/3000/5000/10000/20000 | Upto 4.00% |

|

| Lakshmi Vilas Bank | 1000/3000/5000 | 3.25% - 6.00% |

|

| Oriental Bank of Commerce | 0/500/1000 | 3.50% - 3.75% |

|

| Punjab National Bank | 500/1000/2000/50000 | 3.50% - 3.75% |

|

| Punjab and Sind Bank | 500/1000 | 3.10% - 3.50% |

|

| South Indian Bank | 0/2500/5000 | 2.35% - 5.00% |

|

| State Bank of India | 0/1000/2000/25000 | 2.70% |

|

| Syndicate Bank | 0/100/500/1000 | 3.00% |

|

| UCO Bank | 0/100/250/500/1000/1500 | 2.50% - 2.75% |

|

| Union Bank of India | 0/20/100/250/500/1000 | 3.00% |

|

| United Bank of India | 0/50/100/500 | 3.50% - 3.75% |

|

| Vijaya Bank | 500/1000/2000 | 2.75% - 3.00% |

|

| YES Bank | 0 | Upto 6.00% |

|

How to Open a new Savings Account Online

The procedure for online savings account opening with zero balance is very simple through Wishfin. The portal allows paperless process with no upfront verification. There is instant approval facility available which makes account opening process the easiest thing ever. The details required to apply for online savings account are as follows:

- Full name

- Mobile number

- Email ID

- City

Once the above details are provided, the applicants can compare different banks offering a savings account with zero balance and then apply for the bank as per the choice. The complete process just takes a few minutes.

Savings Account Interest Calculator

Savings Account interest calculator can be used to calculate the estimated investment growth over time. It helps you set a goal and then save money accordingly. The calculation can be done by mentioning the annual interest, invested amount and time period. For a shorter time period, you need to invest more money and vice versa.

Difference between Savings and Current Account

Savings account and current account have some similarities as well as some differences. A current account, on one hand, is one of the important things to have for businessmen as it allows a higher number of transactions on a regular basis as compared to the savings account. There is no interest provided by a current account by most of the banks but the overdraft facility can be availed easily. The minimum account balance (MAB) required on a current account is also very high as compared to the savings account. For better understanding, have a look at some of the basic difference between savings and current account.

| Features | Savings Account | Current Account |

|---|---|---|

| Type of Account | Deposit Account | Daily Transactions |

| Minimum Account Balance (MAB) | 0 | Minimum INR 10,000 |

| Interest Rate | Up to 7% | NIL |

| Free Transactions Allowed | Limited | Unlimited |

| Overdraft Facility | No | Yes |

Thus, savings account, especially online savings account, is suitable for anyone who wants to earn interest on their deposits. Current account, on the other hand, is preferred by the individuals and firms who require monetary transactions on a day-to-day basis. Also, the highest savings account interest rate can be earned on a zero balance account and not on a regular bank account.

FAQs

Below are some of the queries frequently asked about a savings account.

How to check your Savings Account balance?

You can check your Savings Account balance through ATM, NetBanking, SMS and Passbook.

DoP Internet Banking - Post Office Internet Banking

India Post also facilitates internet banking service through DoP internet banking. You can check your account balance or for any other banking services, you can login through its internet banking portal with the help of a username and password.

Tax Exemption on Savings Account

Kotak Savings Account Interest Rate Per Month

Under Income Tax Act 80TTA, interest up to INR 10,000 is exempt from tax. For senior citizens, the tax exemption on a savings account interest rate is up to INR 50,000 under Income Tax Act 80TTB.