Mobile Check Deposit Bank Of America

- Mobile Check Deposit Limits Bank Of America

- Boa Deposit Check By Phone

- How To Deposit Mobile Check Bank Of America

1To send or receive money with a small business, a consumer must be enrolled with Zelle with a linked domestic deposit account at a U.S. financial institution that offers Zelle. Small businesses are not able to enroll in the Zelle app, and cannot send or receive payments from consumers enrolled in the Zelle app.↩

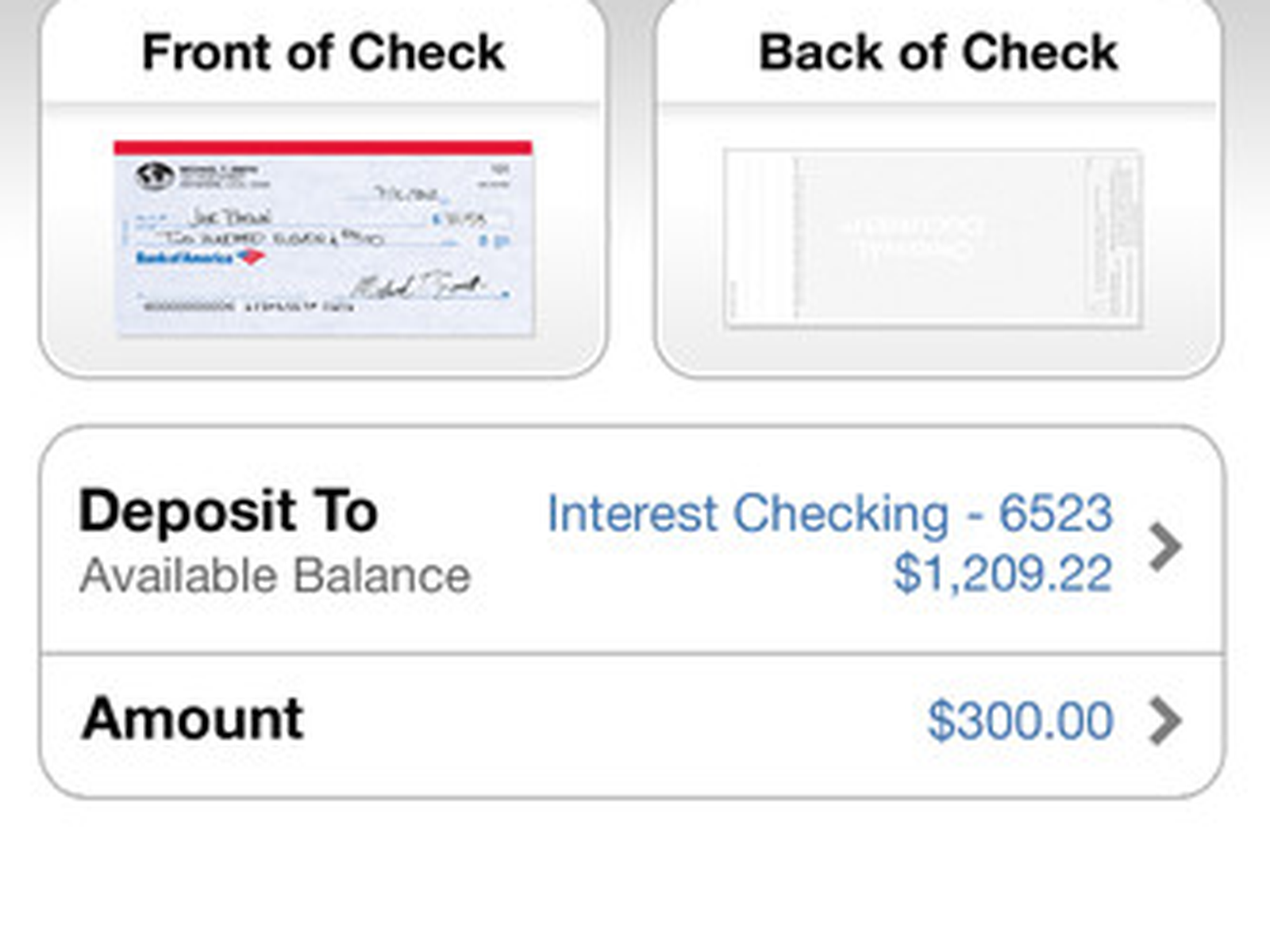

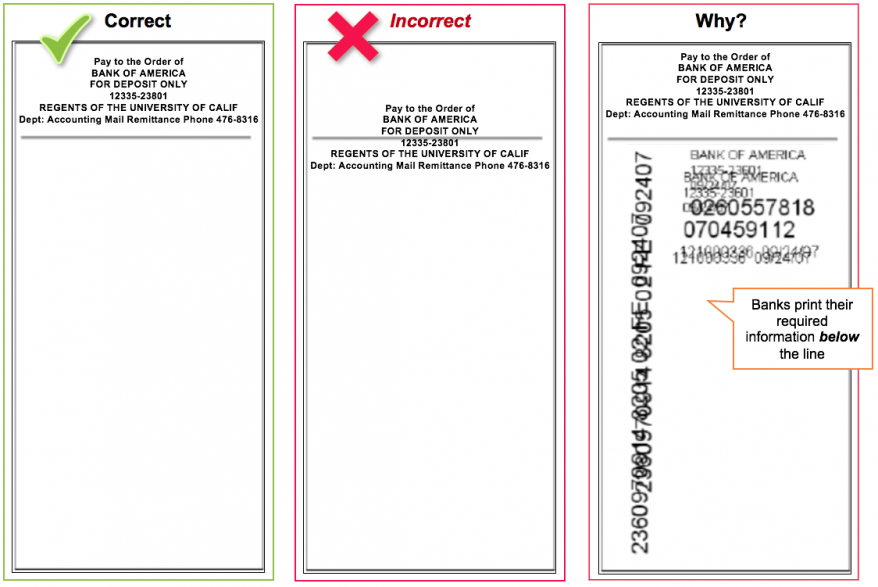

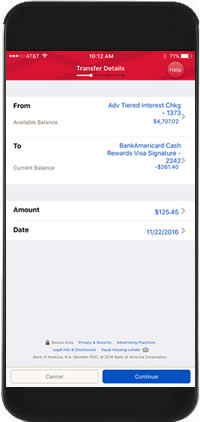

How To Deposit Checks With Bank of America Mobile Deposit. Welcome to Bank of America (Banks - Investment Services) on 748 Walker Rd in Great Falls, Virginia. The bank charges all checking customers a $2.50 fee for using non-Bank of America ATMs in the U.S., and a $5 fee when doing so abroad. It’s easy and convenient to deposit checks and get immediate confirmation with Mobile Check Deposit in Bank of America’s Mobile Banking app. Funds are genera. Mobile Check Deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app, select Deposit Checks, then Help for details, and other terms and conditions. This feature is available on the Mobile Banking app for iPad, iPhone and Android devices. Data connection required. The Bank of America iPhone app has a feature that allows you to deposit your checks right from your phone. Use this article to find out how to deposit a check from your phone, and you won't have to travel to the bank ever again.

2Zelle should only be used to send money to friends, family or others you trust. We recommend that you do not use Zelle to send money to those you do not know. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account to a domestic bank account or consumer debit card. Recipients have 14 days to enroll to receive money or the transfer will be canceled. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle. We will send you an email alert with transaction details after you send money using Zelle. Dollar and frequency limits apply. See the Online Banking Service Agreement at bankofamerica.com/serviceagreement for further details. Data connection required. Message and data rates may apply. Neither Bank of America nor Zelle offers a protection program for any authorized payments made with Zelle. Regular account fees apply. Payments made between consumers enrolled with Zelle do not typically incur transaction fees.↩

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.

3Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.↩

4To receive money from a small business, a vendor must be enrolled with Zelle with a linked domestic deposit account at a U.S. financial institution that offers Zelle.↩

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Microsoft Internet Explorer 6.0 is no longer compatible with Online Banking. To ensure maximum security and the best experience, please:

- Go to the Internet Explorer, Firefox or Chrome websites and download a new browser version

- Review Online Banking system requirements, options for access, notices and disclosures

- Once you have finished, you will need to restart your computer and sign back into Online Banking

Online Banking and eCommunications System Requirements

When you first enrolled in Online Banking, you agreed to receive certain Online Banking notices, disclosures and communications ('eCommunications'). Please refer to your Online Banking enrollment documents for a list of these eCommunications. While you may be able to access Online Banking and eCommunications using other hardware and software, your personal computer needs to support the following requirements:

- An operating system, such as:

- Windows NT, 2000, ME, XP, Vista or Win 7; or

- Mac OS 10

- Access to the internet and an internet browser which supports HTML 4.0 and 128bit SSL encryption and Javascript enabled, such as:

- For Windows NT, 2000, ME, XP, Vista, or Win 7

- Microsoft Internet Explorer 7.0 and higher

- Firefox 3 and higher

- Chrome 3.0 and higher

- For Macintosh using OS 10.x

- Safari 3.0 and higher

- Firefox 3 and higher

- Chrome 4.0 and higher

- For Windows NT, 2000, ME, XP, Vista, or Win 7

Most eCommunications provided within Online Banking or at other Bank of America websites are provided either in HTML and/or PDF format. For eCommunications provided in PDF format, Adobe Acrobat Reader 6.0 or later versions is required. A free copy of Adobe Acrobat Reader may be obtained from the Adobe website at www.adobe.com.

In certain circumstances, some eCommunications may be provided by e-mail. You are responsible for providing us with a valid e-mail address to accept delivery of eCommunications.

Mobile Check Deposit Limits Bank Of America

To print or download eCommunications you must have a printer connected to your computer or sufficient hard-drive space (approximately 1 MB) to store the eCommunications.

Withdrawing Consent to eCommunications and Effect on Online Banking Access

Boa Deposit Check By Phone

How To Deposit Mobile Check Bank Of America

Subject to applicable law, you have the right to withdraw your consent to receiving eCommunications by calling the appropriate toll-free customer service phone numbers listed on the Customer Service tab. You will not be charged a fee for withdrawal of your consent.

If you withdraw your consent, we may stop providing you with eCommunications electronically and we may terminate your Online Banking access. Your withdrawal of consent is effective only after you have communicated your withdrawal to Bank of America by calling the appropriate customer service phone numbers and Bank of America has had a reasonable period of time to act upon your withdrawal. Your consent shall remain in force until withdrawn in the manner provided in this section.