Sbi Recurring Deposit Interest Rate

Just like fixed deposits or FD that have fixed interest rates and tenure, banks offer another type of term deposit known as a recurring deposit (RD) where a specified amount can be deposited at pre-decided intervals.

- SBI allows opening an RD account for a period of 7 days to 10 years depending on the financial goals of the customer. The SBI recurring deposit interest rates offered by the bank on deposit less than Rs. 2 crore is 4.50% and 6.25%. Senior citizens are offered with an additional interest of.

- In case of SBI annuity deposit scheme, the rate of interest is same as applicable to the fixed deposit (FD) account of the term opted by the person India’s top entrepreneurial platform recognises the best SMEs, MSMEs and Startups of the year. Watch Leaders of Tomorrow Season 8 eAwards on 13th of.

The instalment amount once fixed, cannot be altered. Customers can open an RD account in any bank or the post office.

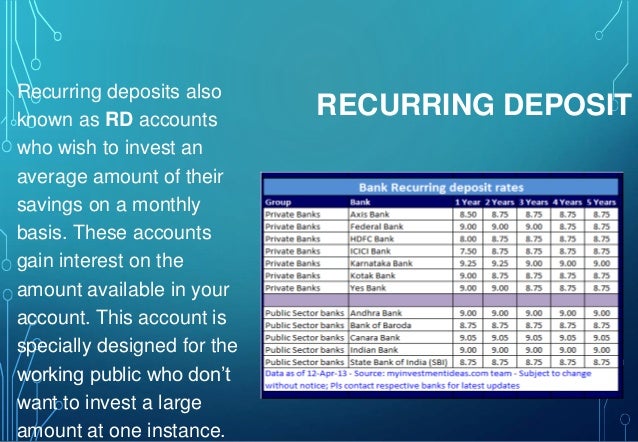

Recurring deposit rates in SBI and post office:

So set aside a small amount every month and earn at compounded rates of interest. Wide Choice in Period of Deposit. Flexibility in period of deposit. Low minimum monthly deposit amount. You can start a Recurring Deposit with SBI Muscat for a monthly instalment of OMR 25 only. SBI Muscat Fixed Deposit Rates Apply. Check out our Interest Rates Online. Rate of Interest as applicable to Term Deposits The interest rate payable to SBI Staff and SBI pensioners will be 1.00% above the applicable rate. The rate applicable to all Senior Citizens of age 60 years and above will be 0.50% above the applicable rate.

-For the general public, RD interest rates in SBI currently vary between 5 -5.4 percent. Senior citizens get an additional interest of 50 basis points. These rates are effective from January 8, 2021. RD interest rates in Post Office are at 5.8 percent per annum, compounding quarterly. These rates are effective from January 1, 2021.

-Maturity of SBI recurring deposits ranging from 1 year to 10 years and Post Office RDs have a tenure of 5 years only.

-Through cheque/cash, an SBI RD account can be opened. However, cash is the only way through which D account in a Post Office can be opened.

-Through net banking facility, SBI RD account can be opened online. Post Office branch has to be visited for opening a post office RD account.

-Customers are required to make monthly deposits of a minimum of Rs 100 and in multiples of Rs 10 in SBI RD account. There is no maximum limit on the deposits. The minimum amount required for opening a Post Office RD is Rs 10 per month or any amount in multiples of Rs 5. However, there is no maximum limit on investment.

-5-year RD rate for Post Office had been decided by the government and the interest rates vary from tenure to tenure for SBI.

Here are the SBI recurring deposit rates

Sbi Nri Interest Rates

| 1 year to less than 2 years | 4.9% |

| 2 years to less than 3 years | 5.1% |

| 3 years to less than 5 years | 5.3% |

| 5 years and up to 10 years | 5.4% |

Here are the 5-year Post Office recurring deposit account (RD)

Bank Term Deposit Interest Rates

5.8 percent per annum (quarterly compounded)