Standard Chartered Fixed Deposit

If you invest in a Standard Chartered Bank fixed deposit, you can get interest rate of up to 7.50% p.a. The tenure range for the FD is between 7 days and 5 years. Standard Chartered Bank FD Interest Rates Range of maturity period: 7 days to 5 years. Invest a once-off deposit of at least R1 000, and leave it to grow for up to five years to earn the highest interest rate. Earn additional interest if you open this account online, in our mobile banking app or at an AutoPlus ATM. Your capital is guaranteed. Apply online now.

- Standard Chartered Interest Rate

- Standard Chartered Fixed Deposit Promotion

- Standard Chartered Term Deposit Rates

Standard Chartered Bank offers Fixed Deposit (FD) products of multiple tenures at competitive interest rates and with many other benefits like loan or overdraft facility against Fixed Deposit. It is very easy to open a Fixed Deposit Account in Standard Chartered Bank

- Standard Chartered Bank Fixed deposit is amongst one such offering. However, it also deals with many other facilities such as flexible durations, choices between simple and compound interest, low deposit amounts and even auto-renewal facilities.Fixed deposit continues to.

- Earn up to 0.55% p.a. Interest 1 on your SGD Time Deposit (Fixed Deposit) today. From 20 January 2021 to 28 February 2021, enjoy interest rate of up to 0.55% p.a.¹ on your 3-month SGD Time Deposit (Fixed Deposit) when you deposit minimum fresh funds 2 of S$25,000.

- Standard Chartered Bank fixed deposit is a great way to save money for a period of time, if you are looking at getting your invested money safely along with good returns on your investment, then.

Eligibility Criteria for opening Fixed Deposit Account in Standard Chartered Bank

Any individual, Minor, HUF, proprietary/ partnership firm, LLP, company, AOP, body of individuals (BOI), local authority, trust, NRI and registered society can invest in fixed deposits (FD).

Documents required for opening Fixed Deposit Account in Standard Chartered Bank

Following Documents are required for opening a Fixed Deposit Account

| Category | Documents Required |

|---|---|

| Individual, HUF, Proprietor |

|

| Partnership Firm |

|

| Trust |

|

| Associations, Clubs |

|

| Company |

|

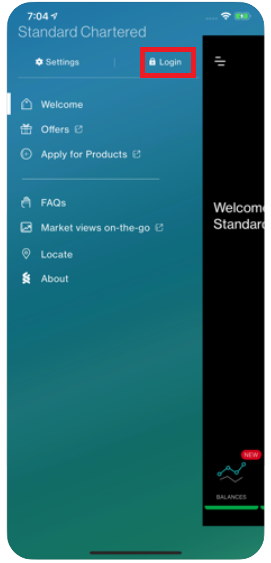

How to open Fixed Deposit Account in Standard Chartered Bank?

In order to open a Fixed Deposit Account in Standard Chartered Bank, you need to follow below mentioned steps:

(1) Personally Visit the Standard Chartered Bank BranchYou need to visit the Standard Chartered Bank branch in which you want to open your FD account.

Standard Chartered Interest Rate

(2) Fill up Fixed Deposit Account Opening Form (FD-AOF)Obtain the Fixed Deposit Account Opening Form and fill up all the necessary details of the customer's information and other details in the different sections given in the prescribed form like name, address, contact number, email id, PAN, type of account to be opened, nominee's name, etc.

(3) Fill up Fixed Deposit TenureYou need to mention FD tenure/ period/ or Term which ranges from 7 days to 10 years.

(4) Attach Cheque for Fixed DepositYou need to attach a cheque worth of that amount you wish to deposit for FD. Alternatively, you can also transfer that amount through net banking.

(5) Attach Required (Mandatory) Documents with the Account Opening Form (AOF)After completing filling up the account opening form, you need to attach KYC documents like PAN, Proof of Address & Proof of Identity.

Some banks make it mandatory to provide Permanent address and telephone number.

(6) Verification of Account Opening Form (AOF) & Other Documents by the BankerBanker will verify Account Opening Form (AOF) and other attached documents. If he is satisfied with these requirements, he will proceed further.

(7) Obtain acknowledgement slip of FD Account Opening Form from Standard Chartered BankOnce your documents are successfully verified, the banker will give you acknowledgement slip of FD Account Opening Form.

Important Points regarding Opening Fixed Deposit Account in Standard Chartered Bank

- Research and select the bank paying maximum rate of interest on Fixed Deposit for the FD tenure you require.

- Different Banks offer different rate of interest under Fixed Deposit Account.

- Select a nearby bank branch.

- Fill the account opening form in CAPITAL LETTERS using black ink.

- Countersign in case of any overwriting while filling up the account opening form.

- You must avail the nomination facility.

- Don't forget to take the original KYC documents with you for verification purpose.

- If your mailing address and permanent address are different, provide address proof documents for both.

Open FD Account in other Banks

FAQ related to Standard Chartered Bank RD Interest Rate Calculator

(1) Can I deposit different monthly installments in RD account?

Answer: No, you cannot deposit different monthly installments in a regular RD account. However, some banks offer Flexi RD which allows customers can deposit any amount at any point in the tenure with no requirement to make deposits every month.

(2) Will TDS be made on RD interest?

Answer: If the interest earned on RD is upto Rs 10,000, no TDS will be made. If it exceed the limit of Rs 10,000 then a TDS at 10% will be made. If your income is non-taxable, then you can submit Form 15G (for non-senior citizen)/ Form 15H (for senior citizen) in order to avoid deduction of TDS.

(3) What is the duration of RD account?

Answer: Usually banks offer RDs of the duration from 6 months to 120 months (10 years). Some of the banks offer RD of 240 months also.

(4) Is there any maximum limit on RD amount that I want to deposit every month?

Standard Chartered Fixed Deposit Promotion

Answer: No, there is no upper cap on RD amount that you want to deposit every month. You can choose any amount according to your financial goals and objective as well as availability of funds.

(5) How the maturity value of Rd is calculated in the calculator?

Answer: The maturity value is calculated taking into account the deposit amount (monthly instalment), tenure and interest rate on RD. It uses compounding of interest formula. Frequency of compounding that the banks offer is quarterly.

(6) How much tax do I need to pay on interest earned on RD?

Standard Chartered Term Deposit Rates

Answer: Tax to be paid by you solely depends upon the tax slab under which you come. It varies from person to person. Persons whose total income (inclusive of RD interest income) is non-taxable need not pay any income tax on RD interest.