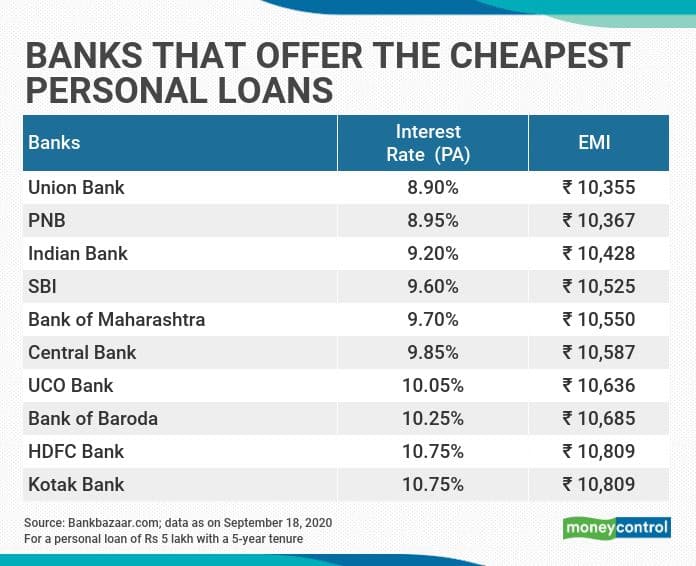

Union Bank Fixed Deposit Rates

Union Bank of India Fixed Deposit Interest Rates for Senior Citizens Senior Citizens are entitled to an additional interest rate for term deposits of one year and more. The additional interest rate offered by Union Bank of India is 0.50% over the normal rate for domestic residents. Union Bank of India FD Calculator: Get details on Union Bank of India FD rates on March 2021 by maturity period, deposit amount & fixed deposit interest rate with Union Bank of India Latest. Union Bank amalgamated with Corporation Bank and Andhra Bank on 1st April 2020, making the entity the fourth largest in terms of the branch network. Features and benefits of Union Bank Fixed Deposit. Multiple Schemes - There are multiple term deposit products offered by Union Bank that you can choose from. These include the following.

- Union Bank Fixed Deposit Rates

- Union Bank Fixed Deposit Rates Sri Lanka

- Us Bank Fixed Deposit Rates

- Union Bank Fixed Deposit Rates 2021

Union Bank of India FD Calculator: Get details on Union Bank of India FD rates on March 2021 by maturity period, deposit amount & fixed deposit interest rate with Union Bank of India Latest.

Table of Contents

- 3 City Union Bank Fixed Deposit Schemes

- 3.7 City Union Bank Fixed Deposit Application Form

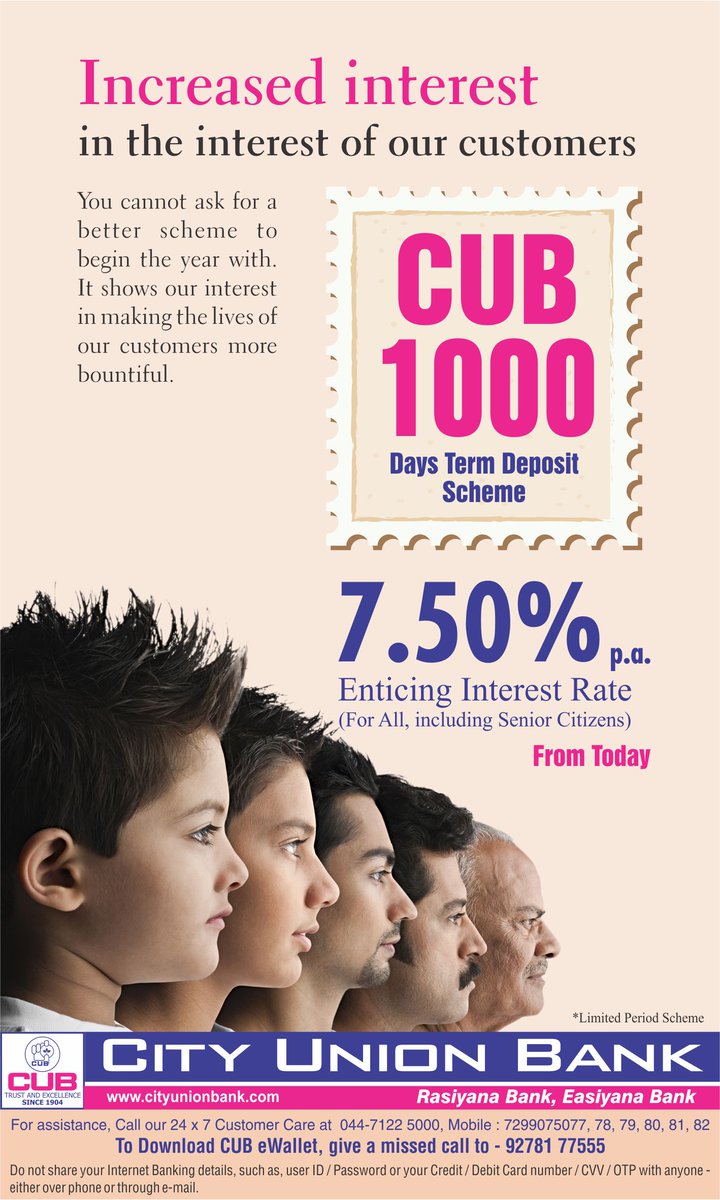

About City Union Bank Fixed Deposit

Take fixed deposit route as a safety of your investment where your deposits earn secured returns after a fixed period of time. It fetches only simple interest payable monthly /quarterly/ half yearly annually. That’s why City Union Bank offers fixed deposits with varying terms, allowing customers to choose a term which best suits their needs.

- The minimum period of Fixed Deposit is 15 Days and maximum period is 10 Years.

- The period of deposit may be outstretched up to a maximum period of 20 years in the case of institutions government undertakings, corporate bodies in order to fulfill their special needs like the creation of sinking fund, amortization fund etc., or for individuals for any other needs.

Union Bank Fixed Deposit Rates

City Union Bank FD Interest Rates March 2021

| Period | General | Senior Citizens |

|---|---|---|

| Less than ₹1 Crore (w.e.f. 28.11.2016) | ||

| 7 days to 90 days | 6.25% | 6.25% |

| 91 days to180 days | 6.75% | 6.75% |

| 181 days to 364 days | 7.00% | 7.00% |

| 1 year | 7.10% | 7.50% |

| Above 1 year & upto 5 years | 6.85% | 7.10% |

| Above 5 years & upto 10 years | 6.70% | 6.95% |

Terms: Senior citizens: Age – Completed age of 60 years.

City Union Bank Fixed Deposit Schemes

Cash Certificate

Cash Certificates are issued by the bank at its branches for maturity values of not less than Rs.100 for such periods and at such rates as may be determined on application.If the deposit amount is over ₹50,000/- the amount will be accepted by way of cheques only along with the Income Tax Permanent account number.

Sri. Chakra Fixed Deposit Scheme

Sri Chakra Fixed Deposit Scheme offers you the following features as:

- Minimum amount shall be Rs.5000/- and thereafter in multiples of ₹5000/-

- Auto renewal of the deposit shall be operative through the system

- Your deposit gets automatically renewed after the period of one year up to a maximum of 4 times.

- Interest is paid periodically as desired by the depositor

Sri. Chakra Plus Deposit Cumulative Scheme

It is a cumulative deposit made under auto renewal and offers the same features listed in Sri Chakra Fixed Deposit Scheme.

CUB Smart Deposit

Union Bank Fixed Deposit Rates Sri Lanka

If you decide to choose CUB Smart Deposit scheme, consider the features covered under this scheme as:

- The deposit is directly renewed after a period of 15 days. There is no requirement to give instructions to the depositor

- Every deposit will renew after a lap of 15 days as deemed fit subject to independent contract.

- Reinvestment of interest along with the principal is made together along with the accrued interest at the time of each maturity, in addition to fresh/additional deposit if any.

- On every cycle, the depositor is given a choice for investing an additional amount or to withdraw any amount from their account in multiples of ₹500/-.

- As per the existing interest rate structure, a deposit made under this scheme will earn interest at the current rate.

- The minimum amount of deposit is ₹10,000/- and in multiples of ₹500/- thereon.

- At any time the balance in the account should not fall below ₹10,000/- if at any time the balance of the account is shown less than ₹10,000/- the account will be closed and the proceeds will be returned.

Flexi-Fix Deposit

Once decided for Flexi-Fix Deposit as your investment, check out the features which are as follows:

- The deposit should be made in the denominations of ₹5,000/= each per unit. Each unit will be known as clusters.

- The initial amount of deposit is decided to be placed at ₹10,000/-.

- Under this scheme, the withdrawals can be made in units of ₹5,000/- and in multiples thereof.

- Withdrawal of amount can be made as per the depositor’s requirements in clusters of ₹5,000/-each leaving the remaining balance intact. (Subject to after a minimum period of 15 days)

- The deposit can be booked for 30 days to any period up to 5 years.

- The cluster deposit will earn interest at the rate as admissible on the period of deposit.

- On maturity of the deposit, the renewal of principal amount is made for the period as desired by the depositor. The interest earned on this deposit will be credited on the quarterly basis either by way of pay order or paid as it is in the depositor’s account. Instructions on the payment and renewal have to be provided by the depositor only.

City Union Bank Fixed Deposit Calculator

In order to know how much interest you can earn on your fixed deposit, use City Union Bank Fixed Deposit Calculator. All you have to do is to enter the amount of deposit, tenure of investment and the rate of interest applicable on that tenure. The calculator will give you the accurate results.

Us Bank Fixed Deposit Rates

City Union Bank Fixed Deposit Application Form

You can download the application form of City Union Bank Fixed Deposit directly from their website. An application form provides the following details which you need to fill it for putting your money in fixed deposits of City Union Bank.

Union Bank Fixed Deposit Rates 2021

- Personal Details attached with a recent photograph

- Name of the scheme

- Duration of the scheme

- Investment Amount

- Nomination details