Bankrate Cd Rates

Named America's best big bank for the fourth year in a row, Capital One offers highly rated checking accounts, savings accounts and CDs. It offers customers free access to thousands of ATMs and a top-notch digital experience.

Highly rated accounts: Capital One offers a range of accounts that pay competitive yields. They also don’t charge monthly fees or require a minimum deposit to open, making them accessible to a range of savers.

Bank and thrift deposits are insured by the Federal Deposit Insurance Corp. Credit union deposits are insured by the National Credit Union Administration.Notes: Example, 'b,i,p' means that the account can be opened as a Business account, or an IRA, or a regular Personal account. ConnectOne Bank CD Rates CD Rates for December 24th, 2019 Ally Bank CD Rates: Comparing Options TotalDirectBank CD Rates TIAA Bank CD rates: 2.10% APY 12-Month CD Busey Bank CD Rates Live Oak Bank CD Rates – 2.15% 12-Month CD (Nationwide) CD Rates Decline Slightly This Week CD Rates Heading Lower in the Coming Months – Lock in Now WauBank.

Free ATM access: Customers have free access to more than 40,000 Capital One and Allpoint ATMs.

Top-notch digital experience: Capital One’s mobile app receives outstanding ratings from its users. It even launched a skill for Amazon's Alexa that lets customers find out information such as their bank account balance.

© Provided by BankrateAlly Bank has it all: top-tier yields on its deposit products, a free checking account that earns interest and a mobile app that stands out from the competition. It also offers free access to thousands of ATMs and reimbursements for fees charged at out-of-network ATMs.

Top-tier yields: Ally Bank offers top yields on its savings account, money market account and CDs. While some banks occasionally offer a top rate on their accounts, Ally consistently is among the best.

Free checking and ATMs: Ally offers a free checking account, so you won’t have to worry about monthly fees and you can even earn a little bit of interest. Customers also have free access to thousands of ATMs, and Ally will reimburse up to $10 each statement cycle for fees charged at out-of-network ATMs.

Mobile app and features: Ally’s mobile app receives strong ratings from users. Customers who download the app have access to a voice-enabled assistant and debit card controls, in addition to other features such as remote check deposit, buckets for savings goals and even an Amazon Alexa integration.

© Provided by BankrateRidgewood Savings Bank is the largest mutual savings bank in New York State and operates 35 branches in the New York City metropolitan area. The bank offers a variety of deposit products, including checking and savings accounts, CDs, a money market account, and even a Vacation and Holiday Club Account. It stands out for its competitive rates, digital banking tools and massive ATM network.

Strong APYs: Ridgewood offers competitive rates across the board on its deposit products, but its savings account truly stands out with a top-tier yield.

Digital features: The bank offers a range of powerful digital banking tools, such as Alexa Voice Banking and Money Management for budgeting.

ATM access: Customers have access to a network of 55,000 surcharge-free ATMs worldwide in the Allpoint network.

© Provided by BankrateChicago-based Alliant Credit Union ranks as the best credit union for the third straight year. Alliant accounts offer competitive yields on a consistent basis. It offers a free checking account that earns interest, and customers have free access to thousands of ATMs. Additionally, Alliant has flexible membership requirements that make it so anyone can join.

Top savings account: All of Alliant’s deposit products pay very competitive yields to help savers reach their goals.

Free checking and ATMs: Alliant customers have free access to thousands of ATMs, and the credit union offers rebates of up to $20 per month for out-of-network ATM use.

Flexible membership requirements: If you don't meet specific criteria listed on its website, you can become a member of Foster Care to Success (FC2S) to become eligible for Alliant membership. Alliant will pay a $5 membership fee to FC2S on your behalf.

Survey: Americans stick with their primary checking account for years

Americans tend to stay with the same financial institution over time, according to a new Bankrate survey of 2,339 adults with a checking account. Additionally, respondents whose household income has been negatively impacted by the COVID-19 pandemic are paying more than four times more per month in fees than those who say their household income has not taken a hit.

The average account holder has been with the same bank or credit union for 14 years, the survey found. The survey also found that respondents that have been hurt financially by the coronavirus pandemic are paying more in monthly fees than those who say their income hasn't been impacted. For those in households that have suffered a setback in income during the pandemic, the monthly average for checking account costs is over $11. Conversely, those who say their household income has not been negatively impacted by the pandemic report paying an average of less than $3 per month.

'Those whose personal finances have been adversely affected by the pandemic have been hit with a double whammy of higher banking fees,' says Mark Hamrick, Bankrate senior economic analyst. 'Unemployment or loss of income can be devastating, but one should try to avoid adding financial insult to injury by paying too much in banking fees when so many less expensive options abound.'

Be sure to shop around and compare financial institutions to ensure you're getting access to competitive products and helpful features, and also not wasting money on fees. Among the banks and credit unions highlighted here, you can find institutions offering free checking, high-yield deposit products, free ATM access and much more.

Methodology for Bankrate’s best banks and credit unions of 2021

Bankrate gathered checking account, savings account, money market account and CD data from dozens of brick-and-mortar banks, credit unions and online financial institutions. In doing so, we examined thousands of data points, looking at the fees each institution charges and the deposit rates it offers. Big banks generally had more than 500 branches across multiple states and regions. Regional banks generally had fewer than 500 branches located in one state or region. Online banks were those without branches or operating as digital financial institutions whose products are widely available online. Credit unions were membership-based organizations regulated by the National Credit Union Administration. The editorial team used its judgment in cases where there wasn't a clear delineation between categories. The research team gathered data from Sept. 11-Oct. 14, 2020, and then gathered APY data a second time from Dec. 7-10, 2020.

We chose one checking account, savings account, money market account and CD from each institution. If an institution didn't offer a given product, it was not scored. However, our methodology did account for the number of products available in the final rating. When an institution offered more than one checking account, we chose the one that offered free checking or the fewest barriers to avoid a monthly fee. In cases where an institution offered multiple free checking accounts, we chose the one that paid the highest APY. If it offered more than one savings account and/or money market account, we chose the one that offered the highest APY at the lowest monthly fee, with a minimum deposit of $25,000 or less. We chose the institution's best CD offer that had a term length between seven and 17 months, when the minimum deposit was $25,000 or less.

We assigned a score to each product category, looking at criteria including fees, APYs, minimum deposit requirements, minimum balance requirements, available CD terms, ATM access, mobile features and more. After scoring each product, we divided the total score by the number of products offered to reach the bank's final score. Each product was given a different weighting in the methodology. In the event of a tie, the financial institution with the higher APY on its savings account at the time of Bankrate's latest round of APY data collection (Dec. 7-10, 2020) received the higher ranking.

To determine the Readers' Choice winners, Bankrate issued a survey via SurveyMonkey for our audience to vote for their favorite financial institutions. Voters could choose from the same banks and credit unions Bankrate reviewed. Voting took place from Dec. 1-31, 2020.

© Provided by Bankrate Aerial view of forest, Texture of mangrove forest from aboveAnytime you deposit into a CD, you promise to leave the money there for a set period of time. When you get a 6-month CD, the money remains in the deposit account for six months. Because you're willing to lock the money away, a bank might be willing to pay you a higher yield on the money.

Popular Searches

If you want to know how much interest you could earn on a 6-month CD, try Bankrate's calculator, which is designed to help you estimate potential earnings. Six months may not be a long time, but it can be useful when it comes to staying on track with your savings goals or setting up an emergency savings ladder.

Summary of Best 6-Month CD Rates March 2021

| Bank | APY | Minimum deposit for APY |

| Quontic Bank | 0.60% | $500 |

| Limelight Bank | 0.50% | $1,000 |

| First Internet Bank of Indiana | 0.45% | $1,000 |

| Navy Federal Credit Union | 0.45% | $1,000 |

| Bethpage Federal Credit Union | 0.40% | $50 |

| TIAA Bank | 0.40% | $1,000 |

| Bank5 Connect | 0.35% | $500 |

| Golden 1 Credit Union | 0.35% | $500 |

| Delta Community Credit Union | 0.35% | $1,000 |

| EmigrantDirect | 0.35% | $1,000 |

| SchoolsFirst Federal Credit Union | 0.35% | $20,000 |

Note: The APYs (Annual Percentage Yields) shown are as of March 1, 2021. The rates for some products may vary by region.

Above are the top widely available 6-month CD rates. Compare these offers, then calculate how much interest you would earn when your CD matures.

Savers looking to get a little extra boost and lock in a yield for a set period of time often look into certificates of deposit (CDs). A CD can help you work toward your savings goals, whether they're long-term or short-term.

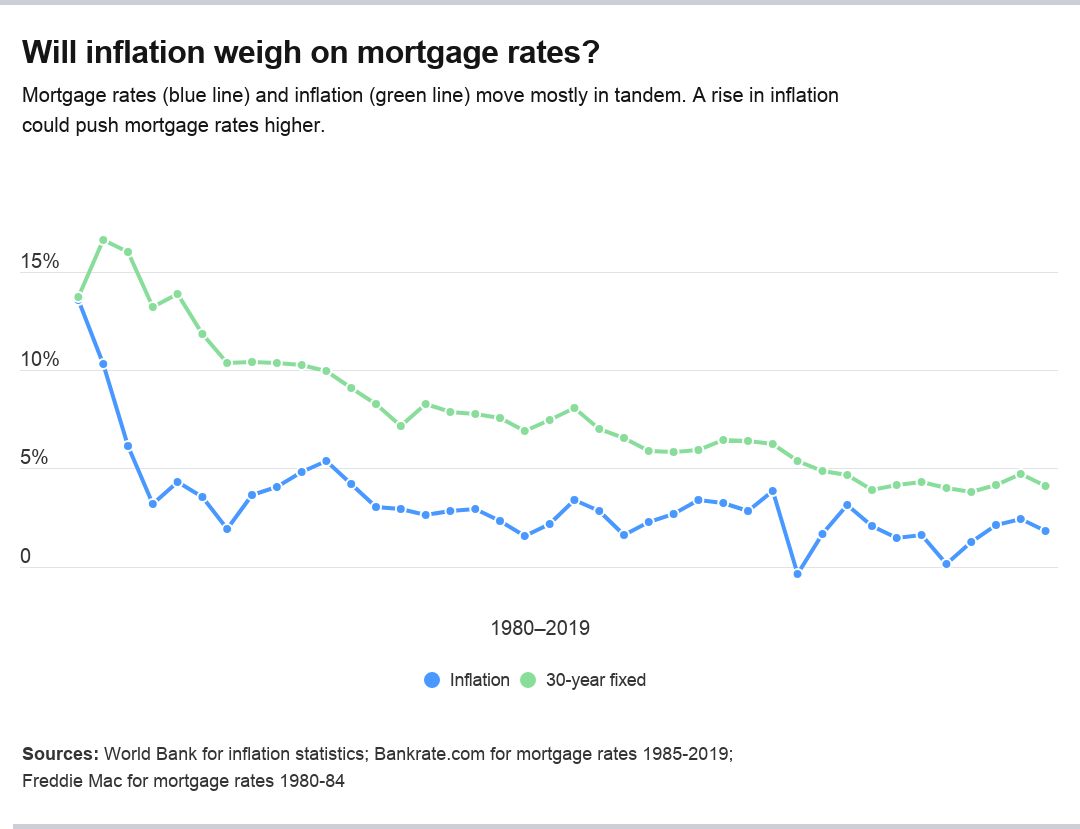

CD yields tend to follow the path of Treasurys and may be impacted by the Federal Reserve's actions. However, once you lock in a yield, you can expect it to be consistent for the entire term of the CD - even if rates fall.

Here's what you need to know about using a 6-month CD to your advantage.

Bankrate’s guide to choosing the right CD rate

Why you can trust Bankrate

Bankrate has more than four decades of experience in financial publishing, so you know you're getting information you can trust. Bankrate was born in 1976 as 'Bank Rate Monitor,' a print publisher for the banking industry, and has been online since 1996. Hundreds of top publications rely on Bankrate. Outlets such as The Wall Street Journal, USA Today, The New York Times, CNBC and Bloomberg depend on Bankrate as the trusted source of financial rates and information.

Methodology for Bankrate’s Best CD Rates

At Bankrate, we strive to help you make smarter financial decisions. We follow strict guidelines to ensure that our editorial content is unbiased and not influenced by advertisers. Our editorial team receives no direct compensation from advertisers and our content is thoroughly fact-checked to ensure accuracy.

Bankrate regularly surveys around 70 widely available financial institutions, made up of the biggest banks and credit unions, as well as a number of popular online banks.

To find the best CDs, our editorial team analyzes various factors, such as: annual percentage yield (APY), the minimum needed to earn that APY (or to open the CD) and whether or not it is broadly available. All of the accounts on this page are insured by Federal Deposit Insurance Corp. (FDIC) or by the National Credit Union Share Insurance Fund (NCUA).

When selecting the best CD for you, consider the purpose of the money and when you’ll need access to these funds to help you avoid early withdrawal penalties.

Top banks offering 6-month CD rates for March 2021

Quontic Bank: 0.60% APY, $500 minimum deposit to open

Quontic Bank is an online bank that offers four terms of CDs: 6 months, 1 year, 2 years and 3 years. All CDs require a minimum of $500 to open.

Quontic Bank also offers a high-yield savings account and money market account. Both pay competitive yields and have low minimum opening deposits.

Limelight Bank: 0.50% APY, $1,000 minimum deposit

Limelight Bank is a division of Capital Community Bank. It has its headquarters in Provo, Utah.

Limelight Bank only offers CDs on its website and requires a minimum deposit of $1,000 on all four of its CD terms. You'll have to look elsewhere if you're looking for a CD with a term of longer than three years.

First Internet Bank of Indiana: 0.45% APY, $1,000 minimum deposit

First Internet Bank of Indiana was the first FDIC-insured financial institution to operate entirely online, according to the bank's website. First Internet Bank of Indiana first opened in February 1999 and is available in all 50 states.

First Internet Bank offers eight terms of CDs, a money market savings account with a competitive yield, a savings account and two checking accounts.

Navy Federal Credit Union: 0.45% APY, $1,000 minimum deposit

Navy Federal Credit Union has more than 9 million members and is the world's largest credit union. It has a global network of 340 branches. Navy Federal Credit Union has its headquarters in Vienna, Virginia.

Membership at Navy Federal Credit Union is open to all Department of Defense and Coast Guard Active Duty, civilian, contract personnel, veterans and their families.

In addition to CDs, Navy Federal Credit Union also offers checking and savings accounts, loans and credit cards.

Bethpage Federal Credit Union: 0.40% APY, $50 minimum deposit

Bethpage Federal Credit Union was founded in 1941 for people working at Grumman.

Bethpage Federal Credit Union is located in Bethpage, New York. It has more than 400,000 members and offers nine terms of CDs. The three-month CD is the shortest term and the five-year CD is the longest term. Bethpage also offers a 39-month bump-up CD.

Besides CDs, Bethpage offers checking accounts, savings accounts, loans and other financial products.

TIAA Bank: 0.40% APY, $1,000 minimum deposit to open

TIAA Bank is a division of TIAA, FSB. TIAA Bank has 10 financial centers, all located in Florida.

TIAA offers CD terms ranging from three months to five years. It also offers a Bump Rate CD, which allows a one-time rate bump if rates go higher. TIAA Bank has a service called CDARS (Certificate of Deposit Account Registry Service) for customers with high deposits who need expanded FDIC insurance coverage.

Bank5 Connect: 0.35% APY, $500 minimum deposit

Bankrate Cd Rates

Bank5 Connect is a division of BankFive. Bank5 Connect has been around since 2013 and BankFive has a history dating back to 1855.

Bank5 Connect offers CDs, a savings account and a checking account.

Golden 1 Credit Union: 0.35% APY, $500 minimum deposit

Golden 1 Credit Union has 1 million members and is headquartered in Sacramento, California. Golden 1 Credit Union has 72 branches in California, and has been around since 1933. Membership to Golden 1 Credit Union is open to all Californians.

Non-Californians can join Golden 1 Credit Union if they are a registered domestic partner or family member of a member. They can also join if they're a member of one of the select employee groups.

In addition to CDs, Golden 1 Credit Union also offers a money market account, checking and savings accounts. The credit union also has credit cards and loans.

Delta Community Credit Union: 0.35% APY, $1,000 minimum deposit

Delta Community Credit Union began as the Delta Employees Credit Union in 1940. It was started by eight Delta Air Lines employees.Delta Community Credit Union has more than 400,000 members and has 26 branches in metro Atlanta and three branches outside of Georgia.

Anyone living or working in metro Atlanta and employees of more than 150 businesses are welcome at Delta Community Credit Union. Delta Air Lines, Chick-fil-A and UPS are some of the eligible businesses.

EmigrantDirect: 0.35% APY, $1,000 minimum deposit to open

EmigrantDirect is a division of Emigrant Bank.

EmigrantDirect has CDs with terms ranging from 16 months to 10 years. All of these CDs require a $1,000 minimum deposit.

On the savings side, EmigrantDirect has its American Dream Savings Account.That savings account doesn't have fees or service charges.

SchoolsFirst Federal Credit Union: 0.35% APY, $20,000 minimum deposit

SchoolsFirst Federal Credit Union was formed during the Great Depression in 1934. The credit union, created by school employees, has 50 branches.

SchoolsFirst Federal Credit Union has low minimum balances and CD terms from as short as 30 days to as long as five years. CDs at this credit union have four balance tiers: $500, $20,000, $50,000 or $100,000.

Coronavirus and Your Money

The COVID-19 pandemic has created financial hardships for millions of Americans.

While CD rates are not likely to rise in this environment, their stability can offer some comfort to those who have extra cash on hand. The rate on a CD stays the same during the deposit term and the account holder knows exactly when that term will end. With their locked-in interest rates, CDs are also a great choice to avoid the stock market's ups and downs.

Finding the best 6-month CD rates

6% Cd Rates Fdic Insured

To find the best 6-month CD rates, savers need to answer two questions:

- How much yield can I reasonably expect to earn?

- What direction are interest rates headed?

Rates are stabilizing. If you’re looking for a short-term CD, it’s best to shop around for the best CD rates.

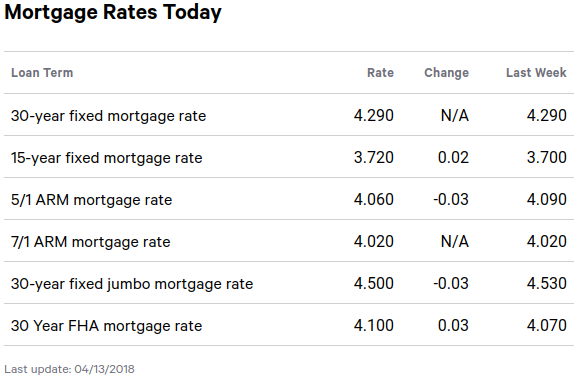

The lower the CD term length, the less interest you can expect to earn. To find the best 6-month CD rates, evaluate offers from online banks and credit unions. Try to avoid accounts with high fees and minimum deposit requirements.

6-month CD FAQs

Best Cd Rates Today

Who should open a 6-month CD?

Six months is one of the shortest terms available for savers interested in CDs. It’s a product that’s best for consumers with specific short-term goals who are looking for a temporary place to keep money that will be used soon for a specific purpose, like funds for an upcoming wedding, vacation or home down payment. A six-month CD could also be a place to keep cash that you’re hoping to put into a riskier investment vehicle.

The longer the term of your CD, the higher the yield you’ll likely have at your disposal. That means 6-month CD yields are typically relatively low. Consider whether it makes more sense to keep your money in a more liquid account, like a savings or money market account. That way, you won’t run the risk of losing interest if you need the money you stashed away before the six month time clock runs out.

Comparing 6-month CDs vs. other savings vehicles

When considering a 6-month CD, it's a good idea to compare it to other available accounts and understand when it might be the right choice for you - and when other options might turn out to be a better decision.

6-month CD vs. savings account

Because you're willing to keep your money in a CD for a set period of time, you usually end up with a higher rate with a CD than a savings account. In fact, you might have a rate that is up to 10 basis points higher on a 6-month CD than on a savings account.

However, savings accounts are more accessible. With a savings account, you won't face the early withdrawal penalties like you do if you tap your 6-month CD before it matures.

Jumbo Cd Rates

6-month CD vs. money market account

There's a good chance you'll get a better yield on a 6-month CD than on a money market account. So, if you're looking for a better yield in a safe account, it can make sense to use a CD instead of a money market account.

On the other hand, a money market account is much more accessible than a 6-month CD. You might even be able to use a debit card to access the funds in the money market account - something you can't do with a CD.

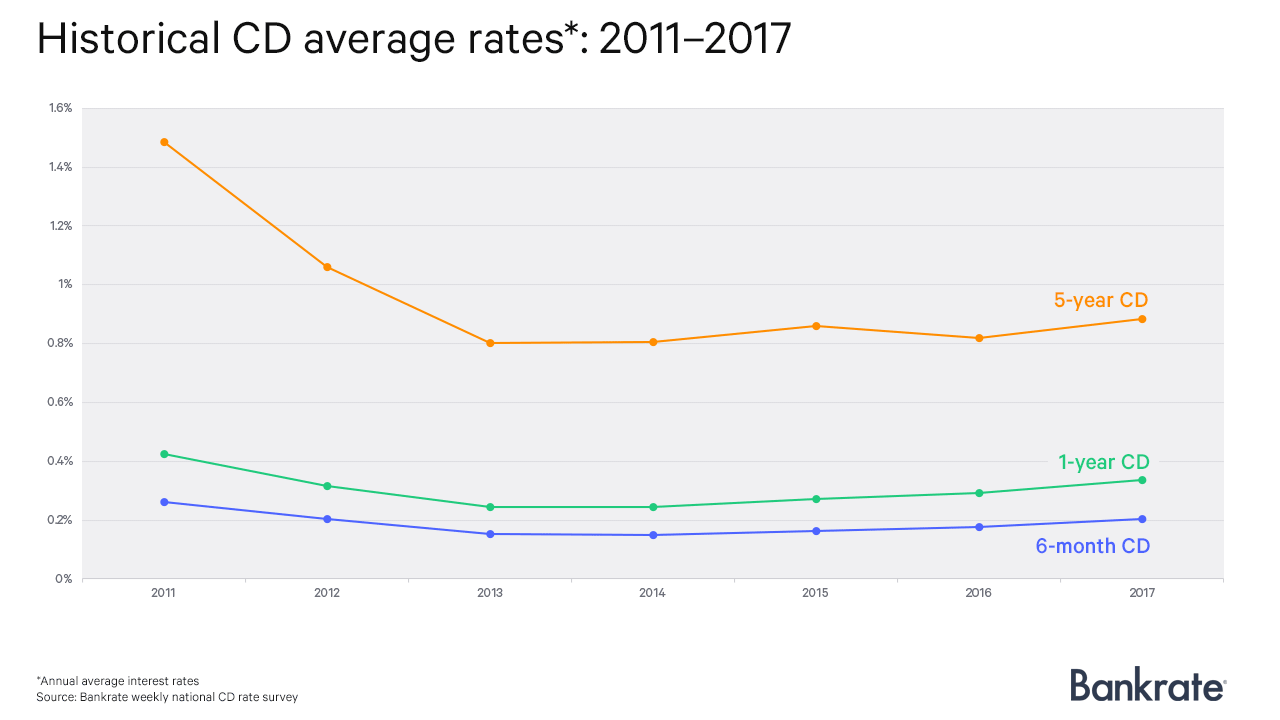

6-month CD vs. 1-year CD vs. 5-year CD

Better yields are generally available on CDs with longer maturities. So, if you're willing to lock up your money for a year - or even up to five years - you could receive a better rate.

However, the advantage of a 6-month CD is that you know you'll be able to access the money in a shorter time frame. Because a CD typically comes with an early withdrawal penalty, you have to be willing to keep your money in the CD until the end of the term or lose out on some of the interest earnings.

How to make the most of a 6-month CD

A 6-month CD works well with short-term savings goals. If you want to set money aside for a specific purpose, but you're worried that you'll be tempted to tap into the funds, a 6-month CD can help make the money harder to get to. You can keep the money safe in an FDIC-insured (or NCUA-insured) account until it's needed.

You can also make use of a 6-month CD in an emergency fund ladder. By setting up a CD ladder that includes shorter-term CDs, it's possible to take advantage of slightly higher yields while knowing that a portion of your money will be available for unexpected expenses in the near future.

Maximize the power of compound interest

Anyone struggling to save money could benefit from having a 6-month CD. Because you could face an early withdrawal penalty, you may be less tempted to tap into your savings prematurely.

Annual percentage yield, or APY, includes the effect of compounding. It's the interest earned on your initial deposit in addition to the interest earned on top of other interest earnings.

Things to keep in mind with a 6-month CD

Before you get a 6-month CD, it's important to understand the potential drawbacks. The early withdrawal penalty is probably the biggest issue. If you access your funds before the six months is up, you'll pay a penalty.

Plus, the yield often isn't much higher on a 6-month CD than you'd see with a traditional savings account. You can shop around for the highest rates, but you might need to meet deposit minimums in order to take advantage of the best yields.

Carefully consider your options before you move forward with a 6-month CD.

Recap: Best 6-month CD rates

- Quontic Bank: 0.60% APY, $500 minimum deposit

- Limelight Bank: 0.50% APY, $1,000 minimum deposit to open

- First Internet Bank of Indiana: Up to 0.45% APY, $1,000 minimum deposit

- Navy Federal Credit Union: 0.45% APY, $1,000 minimum deposit

- Bethpage Federal Credit Union: 0.40% APY, $50 minimum deposit

- TIAA Bank: 0.40% APY, $1,000 minimum deposit

- Bank5 Connect: 0.35% APY, $500 minimum deposit

- Golden 1 Credit Union: 0.35% APY, $500 minimum deposit

- Delta Community Credit Union: 0.35% APY, $1,000 minimum deposit

- EmigrantDirect: 0.35% APY, $1,000 minimum deposit

- SchoolsFirst Federal Credit Union: 0.35% APY, $20,000 minimum deposit for APY